Claim: MTN to prosecute defaulters of Qwikloan and Xpressloan policies.

Verdict: False.

Researched by Rabiu Alhassan

An image that has been widely shared on Facebook is alleging that telecommunication company, MTN is planning to prosecute defaulters of its Qwikloan and XpressLoan policies starting September 16.

The source of the image remains unknown, but it calls on defaulting subscribers of the policies to pay back their loans on or before the close of work on Friday, September 13, 2019.

Embossed on the image is an MTN logo and is titled “Qwikloan and Xpressloan defaulters to be taken to court”, something the telecommunication giant has since denied.

Targeted disinformation against MTN

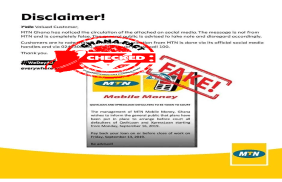

MTN was forced to deny a similar targeted disinformation on the same subject on January 17 after a viral publication on social media alleged the company was pleading with five defaulters to settle their loans.

The telecommunication giant denied being the originator of the publication and described it as a “hoax.”

MTN’s latest response

MTN has again issued another disclaimer on Facebook following the recent viral publication and called on the general public to disregard its contents.

Contractual Arrangement

Unknown to many, all subscribers of the MTN mobile lending service (Qwikloan) are in a direct contractual relationship with a financial services company, AFB Plc(now Letshego-Ghana).

As part of the contractual arrangement for the loan policy, MTN states that all subscribers agree to be bound by the Letshego’s terms and conditions of use of the SERVICE.

Here are some parts of the terms and conditions which can be found in full on afb’s corporate website:

“You acknowledge and agree that MTN is not a party to your relationship with the LENDING INSTITUTION and shall assume no obligation or right in relation to your contractual relationship with the LENDING INSTITUTION, nor shall MTN be liable to you for any damage or loss you may suffer as a result of your use of the SERVICE and dealings with the LENDING INSTITUTION and you hereby absolve and hold MTN harmless against any such losses or damage.”

In an interview with GhanaFact, Managing Director of Letshego-Ghana, Arnold Parker dismissed the reports that defaulters of the loan policy would be prosecuted.

“It is not true. We would not be taking our customers to court,” he reiterated.

REPAYMENT OF THE LOAN

A 12.5% penalty of any amount that remains unpaid on the due date shall automatically apply for defaulting subscribers of the mobile lending service, the terms and conditions of the policy has revealed.

It states further that repayment shall happen by automatic deduction of the repayment amount from your MTN mobile money account on the due date.

If any portion of the repayment amount remains unpaid after the due date any funds deposited into your MTN mobile money wallet will be automatically deducted until repayment of the outstanding balance has been made in full.